This article provides instructions on how to view receipts for various transactions such as sales, payments, QuickCash, refunds, and quotes within a specified date range.

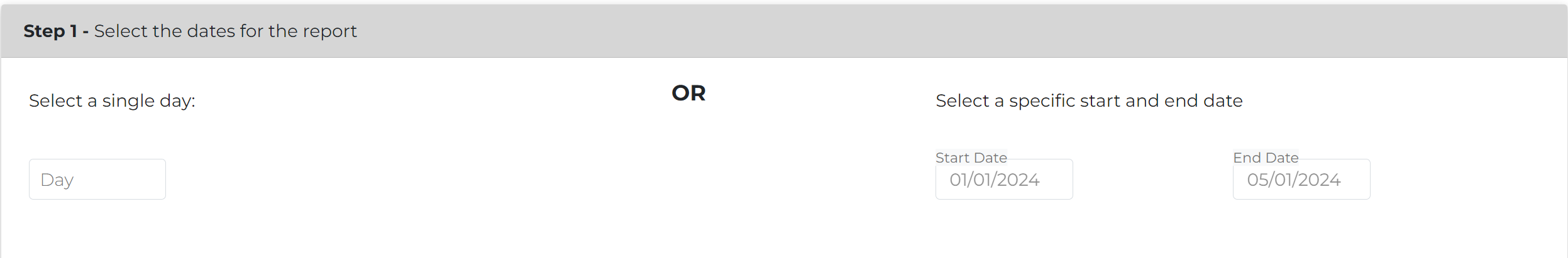

Step 1: Select the Dates for the Report

Choose the timeframe for the receipts:

- Select a Single Day: Choose a specific date.

- Day: Select the desired date.

- Select a Specific Start and End Date:

- Start Date: Choose the starting date.

- End Date: Choose the ending date.

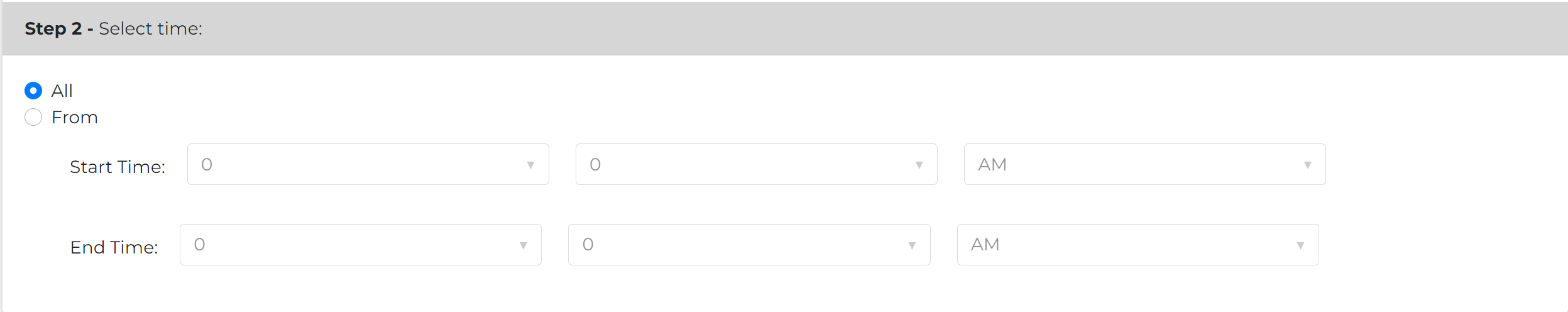

Step 2: Select Time (Optional)

Specify the time range for the receipts:

- All: Include receipts for the entire day.

- From: Select the start time.

- End Time: Select the end time.

Step 3: Select Locations and Auto-Draft Option

Choose the locations from which you want to view receipts. Use the "shift" or "Ctrl" keys to select multiple locations:

- Include Auto Draft Payments: Select this option if you want to include auto-draft payments in the receipts.

Once you have selected the options listed below you will then need to select Generate Report and the following report will be generated.

Explanation of Columns:

- Receipt #: Unique identifier for each receipt. If you click on the receipt number a new tab will open with a copy of the sales receipt.

- Sale #: Sale number associated with the receipt.

- Date Printed: Date and time when the receipt was printed.

- Trans Type: Type of transaction (Sale, Refund, Payment, etc.).

- Credit Card, Finance Co. Direct Deposit, Finance Co. Checks, Client Checks, CASH, CASHIER CHECK/ MONEY ORDER: Payment methods used and amount paid. Note: If the amount is in parentheses this is the amount owed to either the customer or finance company.

- Funds Accounted For: Amount allocated to different payment methods.

- Store Credit, Company Checks: Amounts related to store credit or checks.

- Trans Location: The location where the transaction occurred.

- Trans ID: Transaction ID if applicable.

- Notice: Additional notes or comments related to the transaction.

Interpreting the Receipts:

- Review the receipt details to understand the nature of each transaction (sale, refund, payment, etc.).

- Pay attention to payment methods, allocated funds, and any associated notes for each transaction.

- Cross-reference receipt numbers with other records if necessary for reconciliation or auditing purposes.

By utilizing this information, users can effectively track and manage various transactions within the specified date range.